What is the relationship between the regulated and voluntary carbon markets?

![[:en]Qual é a relação entre os mercados de carbono regulado e voluntário?[:]](https://waycarbon.com/wp-content/uploads/2024/01/Materia-Mercado-de-Carbono-voluntario-e-regulado-768x415.png)

Much has been said about the growth of the carbon market in the world in recent years. In Brazil, market regulation is also advancing. On December 21, 2023, the Chamber of Deputies approved the proposal that regulates the carbon market in the country (PL 2148/15), combining the projects discussed in the Chamber with a proposal already approved by the Senate (PL 412/22). The text creates the Brazilian Greenhouse Gas Emissions Trading System (SBCE), which establishes ceilings for emissions and a securities sales market. In the next phase, the bill returns to the Senate to analyze the changes made by the deputies.

In this context, several questions arise about how this market works, the impacts on companies and the environment, as well as how the relationship between the regulated and voluntary markets works. In this article, you will understand these points based on the analysis carried out by experts from WayCarbon and ICC Brasil in the third edition of the study “Opportunities for Brazil in carbon markets”, published in 2023.

What are the benefits of being part of the carbon market?

Companies that support high-quality carbon projects not only exercise their climate citizenship, going beyond their value chains in their decarbonization journeys, but also practice socio-environmental responsibility. By getting involved in carbon projects, these companies demonstrate their commitment to mitigating the impacts of climate change and contributing to the transition to a low-carbon economy.

In addition to the central objective of climate contribution, the projects have other positive socio-environmental impacts such as improving air quality, creating jobs, preserving biodiversity, community development, technology transfer, education, and environmental awareness.

Regulated and voluntary carbon markets: how do they work?

Carbon credits, generated by projects to reduce or remove greenhouse gas (GHG) emissions, can be purchased by companies or individuals with the aim of offsetting their emissions. These credits can be traded in two types of carbon markets: regulated and voluntary.

In the regulated market, companies use credits to meet obligations imposed by legislation or agreements. There are two types: the international, within the scope of the Paris Agreement, which is being structured with the mechanisms of article 6; and carbon markets regulated at regional, national, and subnational levels, in which sector companies follow specific arrangements for each jurisdiction. This is done through carbon taxes or Emission Trading Systems (ETS), a format approved in Brazil.

The voluntary carbon market consists of the acquisition of credits by companies or other entities to fulfill climate commitments that are not subject to legal obligations to reduce emissions. Has your business already adopted any initiative in this regard?

Interaction between the regulated and voluntary carbon markets

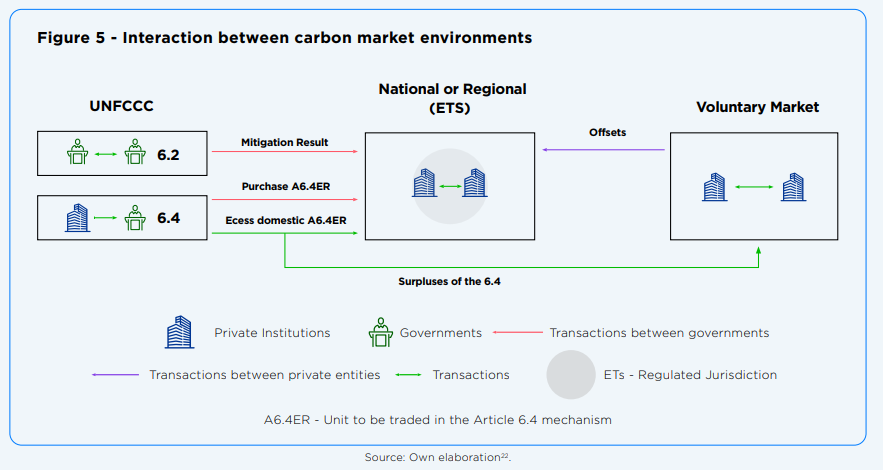

Although each carbon market environment has a different transaction unit, the unit of measurement is the same in all: ton of carbon dioxide equivalent (tCO2e). Therefore, interaction between markets is possible, if permitted by the systems’ regulatory bodies.

Thus, the inclusion of carbon credits from the voluntary market can be used (in a limited way) as a system flexibility mechanism to help meet the goals of a regulated market. See the image below:

Furthermore, it is essential to understand which types of credits from the voluntary market will be accepted in the regulated market, in order to allow a better cost-benefit ratio and, at the same time, the protection of environmental integrity, whose guarantee responsibility lies with the jurisdictions and is related to the ability to represent a real, permanent, additional and verifiable reduction in emissions.

Do you want to know more about solutions for mitigating the impacts of your business on the climate agenda? Speak to one of our experts.

EN

EN  ES

ES PT

PT